Central Banks and Inflation

This is a series about the history of money and the current financial system taken from my book (L)earn Bitcoin

Pt. 1 The evolution of money

Pt. 2 How money is created

Pt. 3 Central banks and inflation

Pt. 4 Bitcoin is not a Ponzi scheme

Pt. 5 Today's Petrodollar System

Lenders of Last Resort

Commercial banks can and have called for the help of the central bank as lenders of last resort. In 2008/2009 the banks, who were responsible for the global financial crisis, received their bail-out money. They were rescued because they were "too big to fail". And what did they do with the money? They bought back shares in their own companies. Nothing "trickled down" down into the economy. The gap between rich and poor inevitably became bigger and bigger.

Central banks are called lenders of last resort. The objective is to prevent economic disruption as a result of financial panics, and bank runs spreading from one bank to the next due to a lack of liquidity. Financial actors like banks know that the central banks will have to bail them out, which leads to moral hazard - excessive risk-taking by both bankers and investors.

The creation of artificial money through central banks overshadowed the distortion in the market. Because of the flooding and manipulation of the monetary system with cheap money, there is no rational price finding mechanism anymore. Usually, supply and demand determine the value of goods and commodities but, in a distorted and manipulated market, there is no room for fair price discovery. The global middle class is paying for the financial elites' greed which, in turn, is being fed by a corrupted system of money creation.

Have you, as an individual, ever been bailed out? And if you have, would you do the same thing over and over again, rigging the system knowing that there is a last resort, which will always bail you out? This is exactly what banks, Wall Street, Hedge Funds and their lobbying lawyers do constantly, assisted by central banks all over the world.

"Classically, central banks hold reserves in case of emergencies, set interest rates, and allocate funds to stimulate or slow economies after disruptive events like panics or wars. The more recent role they have assumed is one of securing the entire financial system and influencing the economic trajectory of entire sovereign nations. This is the antithesis of democratic rule. Such a monetary oligarchy operates beyond democratic norms and limits." [^7]

Naomi Prins' book tapped into the psyche of Wall Street, revealing how the very structure of the financial system hinged on traders flocking to the next big bet, regardless of the stakes. In addition, the same people and families kept popping up, cycling through Wall Street and Washington. They influenced the economy beneath them from their loftier heights of status, private money and public office, dismantling laws that stood in their way and finding loopholes through others. Private banks normalized market manipulation. Central banks made it an art form, with no limits." [^8]

Money Supply Inflation

Let's take the US Dollar as an example for all fiat currencies. Because of money supply inflation, the more USD are available, the less value a single note has. Imagine a banknote as a commodity like copper. If there is more copper on the market than there is demand, the price of copper is falling; its value is decreasing. The same is true for your banknote. The value of fiat currencies is determined by supply and demand too. If you increase the supply and the demand stays the same, the value of one unit decreases.

The money supply consists of various types of money that are generally classified as Ms, such as M0 (base money), M1, M2 and M3. The definitions might vary slightly in different countries.

The monetary base (M0) is the total amount of a currency in physical paper and coin that is either in circulation in the hands of the public or in the form of commercial bank deposits held in the central bank's reserves. [^9]

As long as you hold cash, it is an asset like bitcoin, a property that you own. If you take your cash and store it at the bank, you have a claim, but don't own the money anymore. Similar to bitcoin at an exchange.

Any other fiat money supply (M1, M2, M3) is comprised of claims on base money. [^10]

M1 includes M0, demand deposits, traveler’s checks, and other checkable deposits, that are easily convertible to cash.

M2 includes M0, M1, money market securities, mutual funds and other time deposits. These assets are less liquid than M1 and not as suitable as exchange mediums, but they can be quickly converted into cash or checking deposits. M2 is closely watched as an indicator of money supply and future inflation, and as a target for central bank monetary policy.

The amount of M2 currency in circulation in the US was 19.7 trillion USD in February 2021. [^11] Look at the growth in 2020.

"We accept this as normal because we assume it will never end. The fractional reserve banking system has functioned around the world for hundreds of years (first gold-backed, and then totally fiat-based), albeit with occasional inflationary events along the way to partially reset things.

Each individual unit of fiat currency has degraded about 99% in value or more over a multi-decade timeline. This means that investors either need to earn a rate of interest that exceeds the real inflation rate (which is not currently happening), or they need to buy investments instead, which inflates the value of stocks and real estate compared to their cash flows and pushes up the prices of scarce objects like fine art." [^12]

Adding to money supply inflation is the fact that the population in the US and other western nations is not growing at the same rate as the money supply. "US population used to grow at maybe 1.5% per year, and now grows closer to 0.5% per year. That's pretty important. Meanwhile, broad money supply is up 25% year over year, and is on track to be up 75%+ over a rolling 5-year period in the future." [^13]

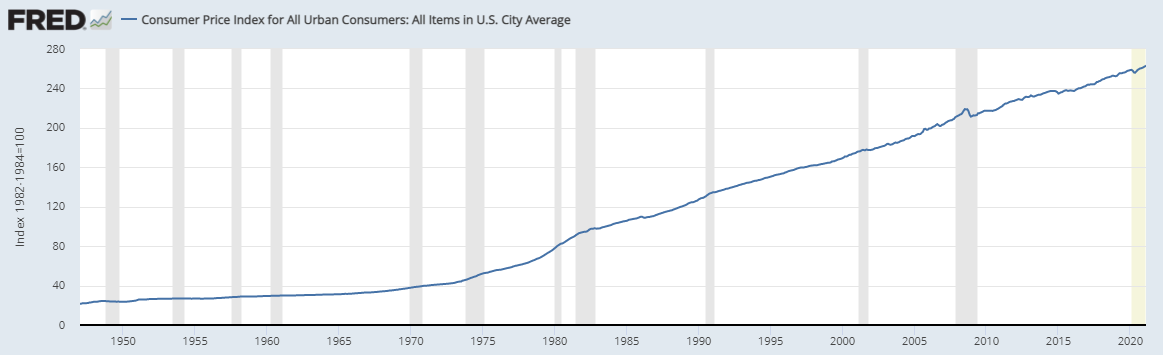

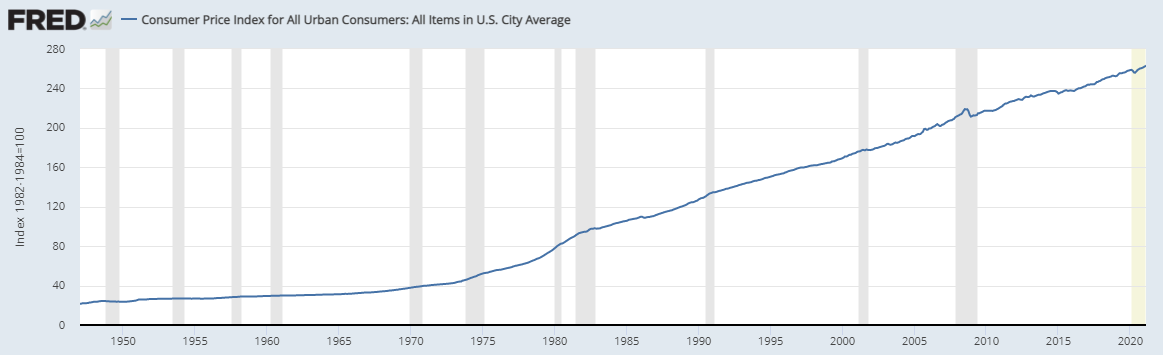

Strictly speaking, inflation occurs when the money supply outstrips nominal GDP growth, which consists of population and productivity growth. The Consumer Price Index of the USA shows that the prices for goods went up since the value of money has declined.

[^14]

[^14]

Next week, I'll answer the question if Bitcoin is a Ponzi scheme.

[^7]: Collusion, by Nomi Prins, Bold Type Books, 2019, p. 7.

[^8]: Collusion, by Nomi Prins, Bold Type Books, 2019, p. xvii

[^9]: Monetary Base

[^10]: Global Monetary Base, Crypto Voices

[^11]: FRED, M2 Money Stock

[^12]: Lyn Alden, Ponzi scheme

[^13]: Lyn Alden

[^14]: US Consumer Price Index

This content is part of my (L)earn Bitcoin book available as paperback and ebook.

{|<}earn-Bitcoin-book.png)

Subscribe to (L)earn Bitcoin

Subscribe for my weekly newsletter. It's free.

[^14]

[^14]earn-Bitcoin-book.png)